About Paytm Payments Bank Update: What You Need to Know

In the dynamic landscape of banking and financial services, changes can occur swiftly, impacting both institutions and customers alike. Recently, Paytm Payments Bank, a prominent player in India’s banking sector, received a directive from the Reserve Bank of India (RBI) that will significantly alter its operations. As a valued customer, staying informed about these developments is crucial to understanding how they may affect your banking experience. In this article, we’ll look into the specifics of the recent Paytm Payments Bank update, highlighting important information and actionable steps for customers.

The RBI Directive: What You Need to Know

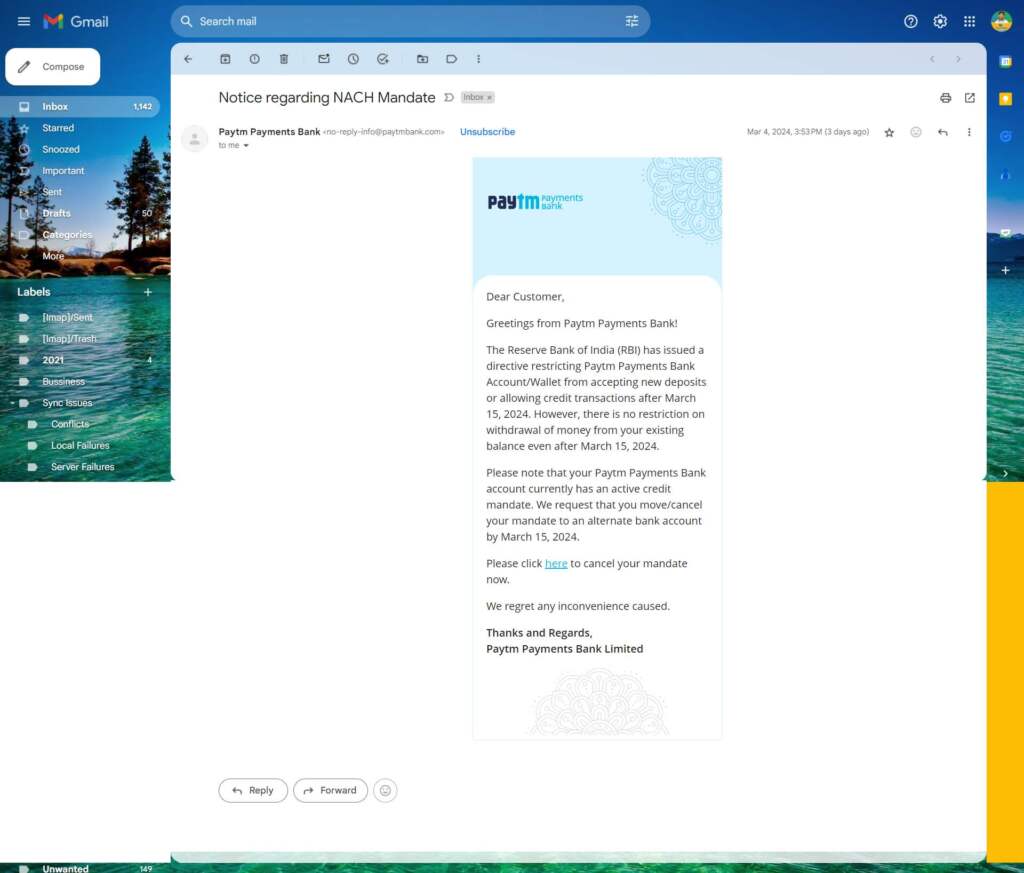

Effective March 15, 2024, Paytm Payments Bank will face certain restrictions outlined by the Reserve Bank of India. Let’s explore the key points:

1. New Deposits and Credit Transactions

- Paytm Payments Bank will no longer accept new deposits or facilitate credit transactions after March 15, 2024.

- Customers will not be able to add fresh funds to their accounts or receive credit following this date.

2. Withdrawals from Existing Balance

- Despite the restrictions on new deposits, existing account holders can continue to withdraw money from their current balance without any hindrance.

- Whether it’s paying bills, making purchases, or accessing cash, existing funds remain accessible to customers.

3. Active Credit Mandate

- Customers with active credit mandates, such as auto-debits for bill payments or loan repayments, need to take prompt action.

- By March 15, 2024, customers must move or cancel their mandate and link it to an alternate bank account to ensure a seamless transition and avoid disruptions to financial commitments.

Related Articles

What Should You Do?

1. Cancel Your Mandate

- Visit the cancellation link provided by Paytm Payments Bank to cancel any existing credit mandates.

- This simple process ensures that your payment instructions are up to date and prevents any potential disruptions.

2. Review Your Account

- Take a moment to review your Paytm Payments Bank account thoroughly.

- Check for any pending transactions, scheduled payments, or standing instructions that may need attention.

- If you have questions or concerns, the customer support team is readily available via the Paytm app or website to assist you.

FAQs – Frequently Asked Questions

1. Why is Paytm Payments Bank undergoing changes?

Paytm Payments Bank is making changes as directed by the Reserve Bank of India to comply with regulatory requirements and enhance its services for customers.

2. What do I need to do to stay informed about these changes?

To stay informed, keep an eye out for communications from Paytm Payments Bank regarding the updates. You can also visit their website or contact customer support for clarification.

3. How can I ensure minimal disruption to my banking experience during this transition?

To minimize disruption, it’s crucial to understand the updates and take appropriate actions. Cancel any active credit mandates, review your account for pending transactions, and reach out to customer support for assistance if needed.

4. What if I have active credit mandates set up with Paytm Payments Bank?

If you have active credit mandates, it’s essential to move or cancel them by the specified deadline to avoid any disruptions to your financial commitments.

5. How can I review my account for pending transactions?

You can review your account for pending transactions by logging into your Paytm Payments Bank account online or through the mobile app. Look for any outstanding payments or scheduled transactions that may need attention.

6. What should I do if I need assistance or have questions about these changes?

If you need assistance or have questions about the changes, don’t hesitate to reach out to Paytm Payments Bank’s customer support team. They’re available to provide guidance and support to ensure a smooth transition for customers.

Summary

As Paytm Payments Bank undergoes changes mandated by the Reserve Bank of India, it’s essential for customers to stay informed and proactive. By understanding the implications of these updates and taking appropriate actions, customers can navigate this transition with confidence and ensure minimal disruption to their banking experience. Remember to cancel any active credit mandates, review your account for pending transactions, and reach out to customer support if needed. With careful planning and timely action, customers can continue to access the services they need and manage their finances effectively in the evolving landscape of banking and financial services.